Payslip Template and Employee's Salary Slip in Malaysia

Employee’s Payslip in Malaysia

Employee Payslip also known as salary slip is a record for both employers and employee when employee received their salary. It is a document that provided by employer to employee which indicates that, the company has provided employee salary throughout certain working period.

Moreover, payslip is given to workers whose salary and wages can vary according to number of hours or days they work. Regardless, they both indicate single employee earnings throughout a certain working period.

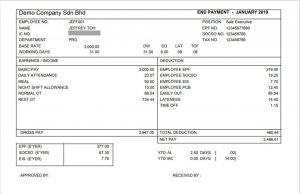

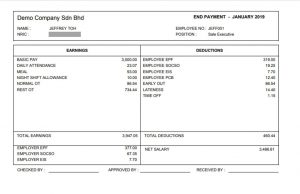

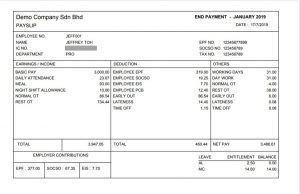

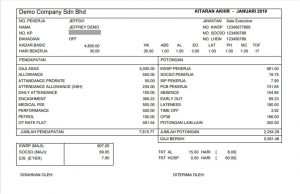

Payslip format in Payroll HRMS Malaysia

Payslip should be clearly stated employee personal info including employee’s name and code, employee’s personal IC, salary earned (including gross salary and deduction) and the given date of payslip.

Learn more about iFLEXiHRMS Payroll System towards employee Payslip template in Malaysia

iFLEXiHRMS Payroll System allow you to customize employee payslip template in Malaysia. It is a simple and easy payroll software system by allowing your company one click generate employee payslip in Malaysia.

iFLEXiHRMS Payroll System free up your time from tedious and complex payroll calculations, annual leave, preparation of pay slips and all statutory submissions. It built for your business, and grow with your business.

The importance of Payslip in Payroll HRMS Malaysia

Employee’s Payslip will decide the fate of paying taxes. A salary slip is a tax references for allowing you to pay government taxes easily.

The salary slip ensures access to certain services from the government that are given free or with heavy subsidy. This will include state-run medical care and cheaper food grains from public distribution system.

Furthermore, payslip are important for bank credit, loans, housing mortgage and other borrowings. It is the essential tools or proof to form a hire purchase trust between a debtor and the provider. Salary slip become a measurement of hire purchase amount, a single documents speak it all.

A pay slip plays a role of bargaining chip when negotiating salary with a new employer. Most of the companies in Malaysia will request job applicant to print out their last month of salary slip as a proof of his/her past earnings. The later will bring up to the table for new salary decision making.

Payment of Employee’s Salary – Employment Act of Salary Slip

Employer and employee comes to an agreement when come to contract of working and payments. There are several rules that should be highlighted to a company HR when processing employee payslip.

- Employee Salary Slip & Wages Period

- A contract of service shall specify a wage period not exceeding one month.

- If in any contract of service, no wage period is specified the wage period shall for the purposes of the contract be deemed to be one month.

- Time of payment of Wages

- Every employer shall pay to each of his employees not later than the seventh day after the last day of any wage period the wages, less lawful deductions, earned by such employee during such wage period:

- Provided that if the Director General is satisfied that payment within such time is not reasonably practicable, he may, on the application of the employer, extend the time of payment by such number of days as he thinks fit.

- In other words, an employee shall get his/her payslip at the first 7 days in a month (in most situation, employee working hour is calculated at the end of month so do employee salary slip)

If any of the employer or company failed to execute the above laws and regulations, an employee is able to file a complaint to Department of Labour of Peninsular Malaysia, also known as Jabatan Tenaga Kerja Semenanjung Malaysia (JTKSM) for further assistance.

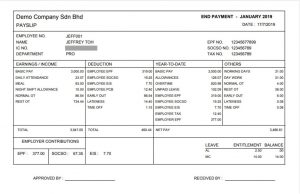

Types of Payslip in Payroll HRMS Malaysia

There are three types of payslip which are Normal Payslip, Adjustment Payslip and Supplementary Payslip. Each payslips are used under different circumstances and conditions.

Normal Payslip: Normal Payslip is the payslip that always used for monthly paid from employer to employee.

Adjustment Payslip: This payslip is used when an employee had been overpaid or underpaid. It is used to make a changes of amount on payslip.

Supplementary Payslip: Supplementary payslip is used when there is an extra payment is paid to the employee after issued normal payslip had been issued. Supplementary payslip can be used when paying for overtime or bonuses.

Learn more about iFLEXiHRMS Payroll System towards employee Payslip template in Malaysia

iFLEXiHRMS Payroll System allow you to customize employee payslip template in Malaysia. It is a simple and easy payroll software system by allowing your company one click generate employee payslip in Malaysia.

iFLEXiHRMS Payroll System free up your time from tedious and complex payroll calculations, annual leave, preparation of pay slips and all statutory submissions. It built for your business, and grow with your business.

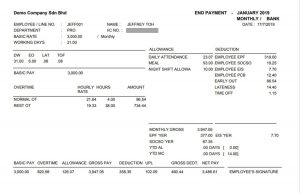

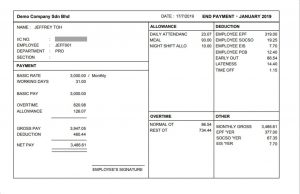

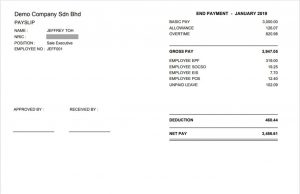

Bahasa Melayu Payslip Template

iFlexiHRMS Payroll System is capable for generating Bahasa Melayu Payslip Template. A company HR is not required to translate employee salary slip one by one.

Below are the payslip comparison side by side with Melayu version and English version.

Related Products from iFLEXi

Found Our Solutions Helpful To You?

Hit the request demo button, fill in a simple form and our staff will contact you as soon as possible.