SOCSO Contribution is a compulsory contribution for Malaysia employees, whom are met under certain conditions and requirement, in Payroll HRMS Malaysia.

Learn more about SOCSO Contribution and Calculation here

What you need to prepare by submitting employee’s SOCSO contribution?

For each of the employee’s paid, employers are required to contribute employee SOCSO contribution, you may learn more about vary of employee pay type in Payroll Malaysia, which leads different deduction and contribution in HRMS.

So here is the requirement you need to prepare while checking and updating your employee’s SOCSO contribution,

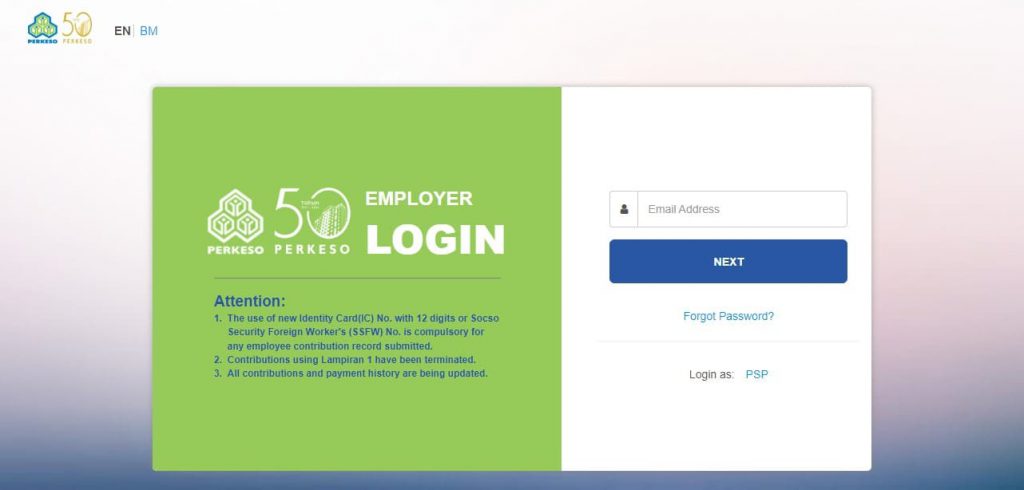

1.Login to SOCSO (PERKESO) website

In your browser enter https://assist.perkeso.gov.my/employer/login

Enter your credential and login to SOCSO portal.

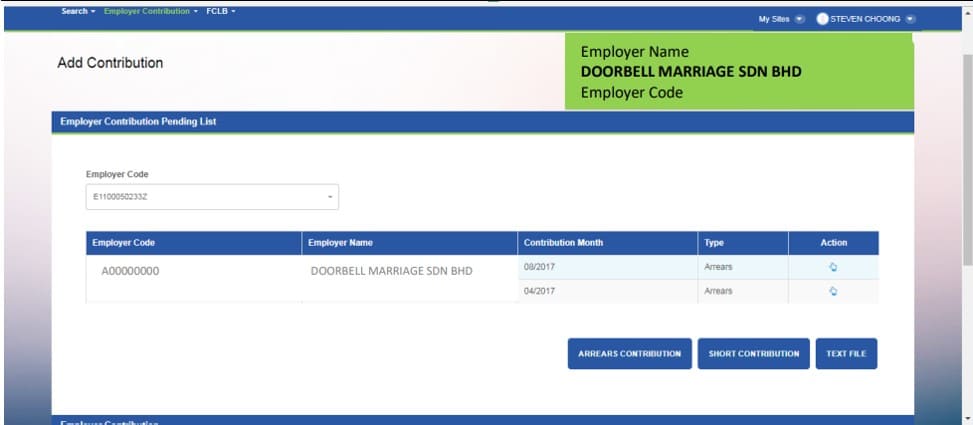

2.Add employee contribution

3. Go to my site menu and select contribution.

Select Employer contribution on the menu bar, and then select sub menu “Add Contribution (Portal)”

4. Click the Edit icon in the action column by updating your employee contribution details.

So here is the requirement you need to prepare while submitting your employee’s SOCSO contribution

1. Login to SOCSO (PERKESO) website

In your browser enter https://assist.perkeso.gov.my/employer/login

Enter your credential and login to SOCSO portal.

2.Add employee contribution

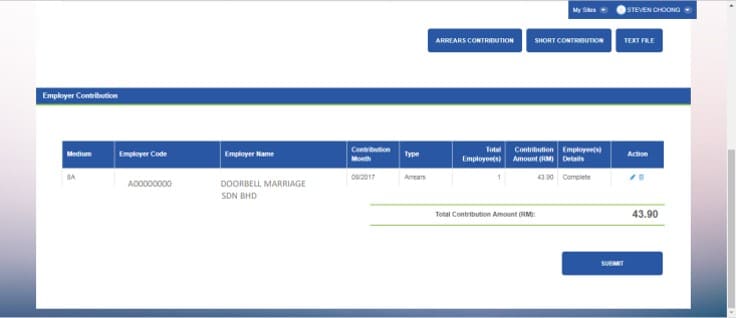

3.Go to my site menu and select contribution.Select Employer contribution on the menu bar, and then select sub menu “Add Contribution (Portal)”

4. Select an employee and click text file

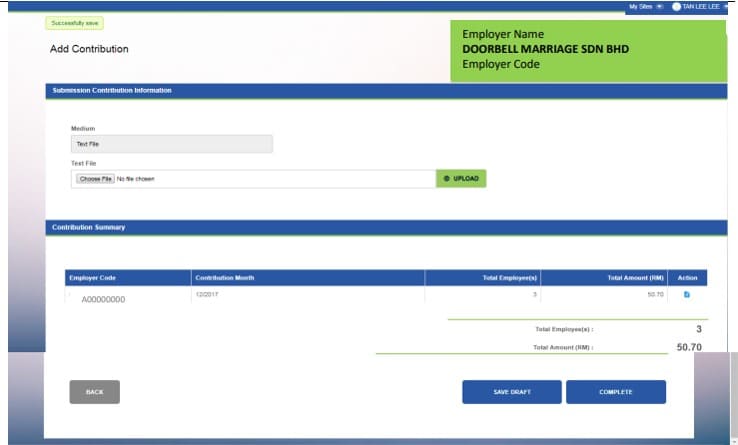

5. Upon appearing total amount, click Save, and then click Back

6. Click Submit

7. Process Payment to SOCSO (PERKESO) for completing employee’s SOCSO contribution

Learn more from SOCSO (PERKESO) pdf here.

Having trouble for submitting your employee SOCSO contribution? Contact us now for free consultation!