What is CP22 and CP22A and what you should do about it?

CP22 and CP22A is a form of income tax that employer had to submit(notify) to the LHDN under several employee activity and conditions:

CP22: Employer submit CP22 form to LHDN Malaysia while there is a newly recruited employee

CP22A: Employer submit CP22A form to LHDN Malaysia while there is an employee retire, or employee is about to leave Malaysia permanently.

Both CP22 and CP22A shall submit to the nearest assessment IRB branch within one month of notice before leaving/joining the company.

However, employer is not required to send notification (submit form for CP22A) to LHDN while employee is under several conditions:

- Employee is entitled to MTD and deduction has been made by the company employer

- The remuneration of employee is lesser or under the minimum income subject to MTD

- Employee is not leaving Malaysia after his/her retirement.

Download CP22 form and CP22A form in Malaysia

Download your CP22 form here

Download your CP22A from here

Here are the steps for showing how to submit CP22A (in mandarin)

Click the link below to view the process of CP22A in mandarin https://www.facebook.com/FlexiTeamComputer/posts/3653904918039448

How to Submit CP22 & CP22A

First, proceed to www.hasil.gov.my LHDN official website to submit CP22a

Under [Hubungi Kami], select [Malkumbalas Pelanggan].

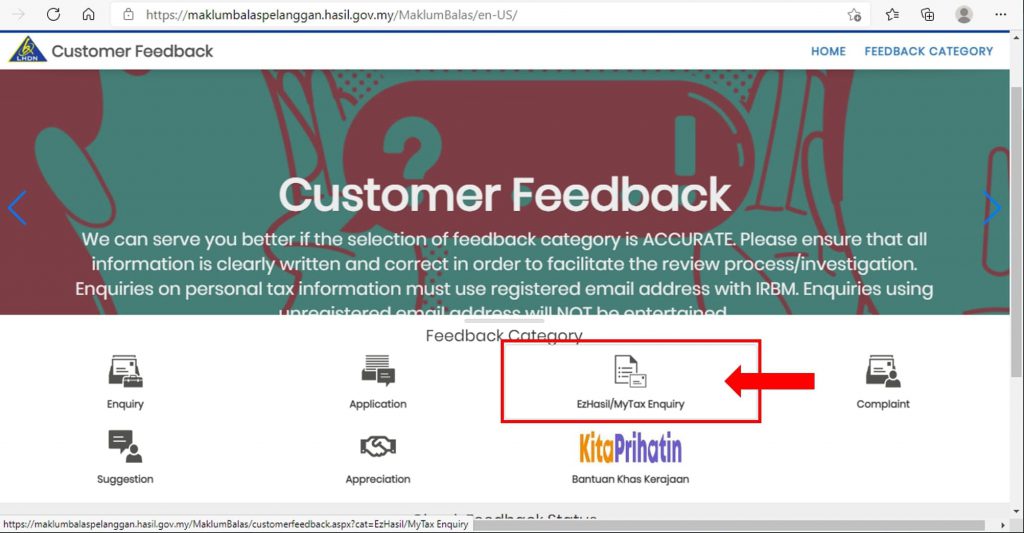

After redirect you to a new page, select [EzHasil/My Tax Enquiry]

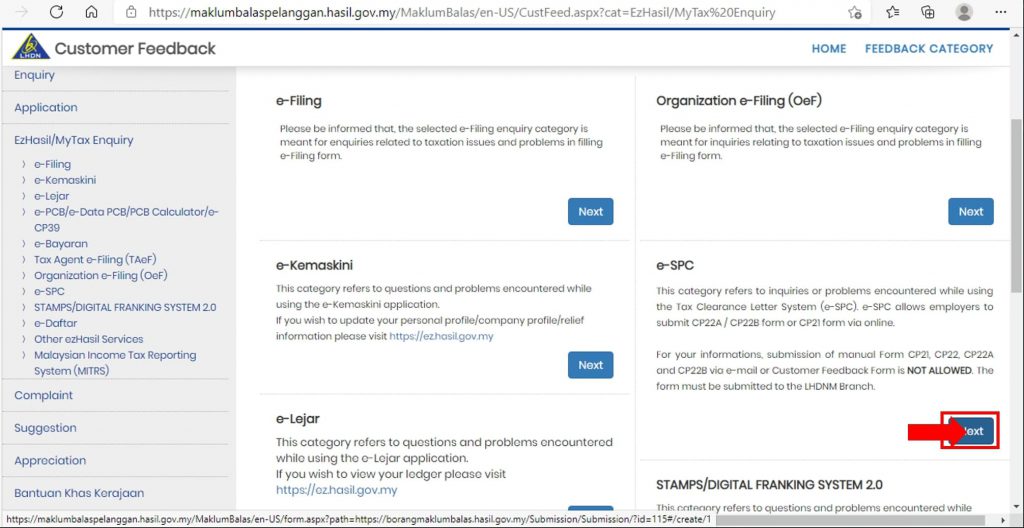

Scrolling down to [e-SPC] Click [Next] on it.

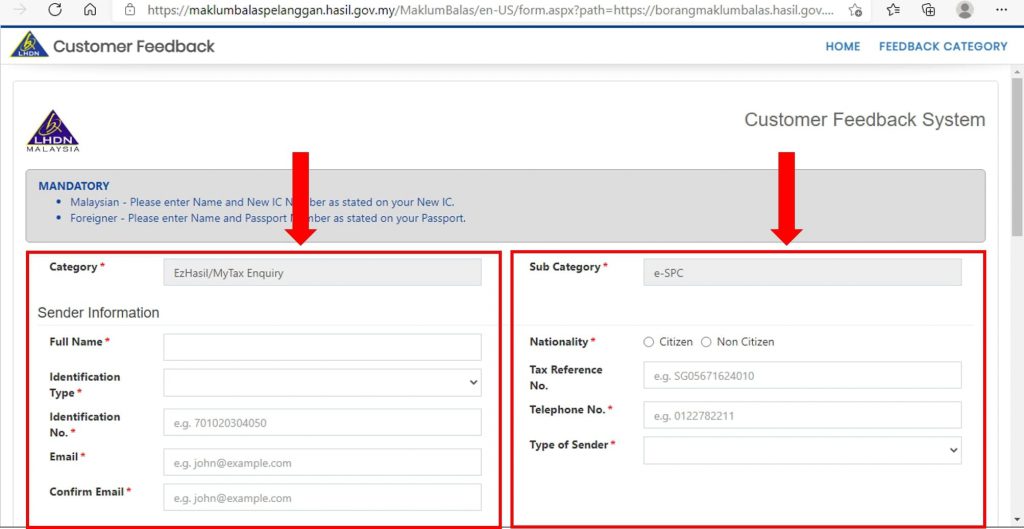

After that, fill in the below form and particulars.

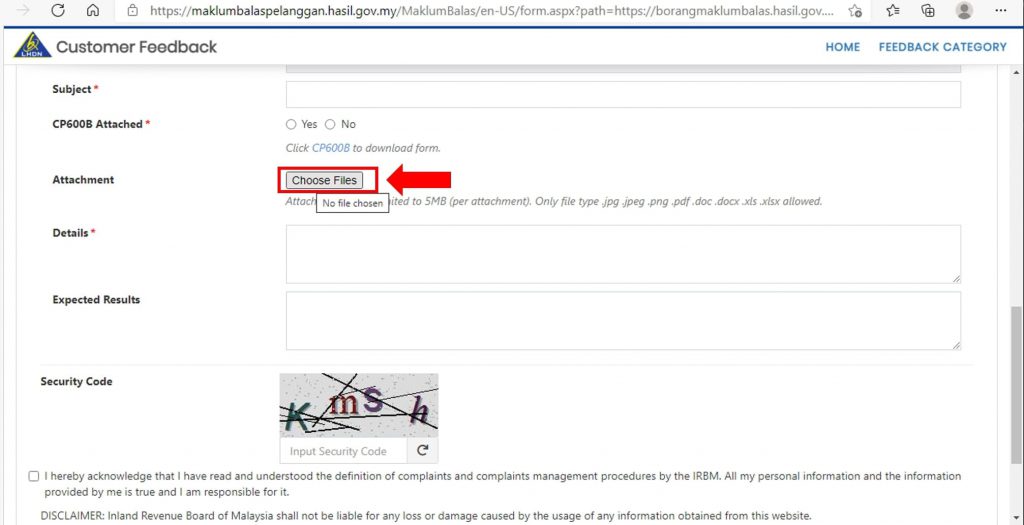

At the [Attachment] section, select [Choose Files] to upload your employee relative form.

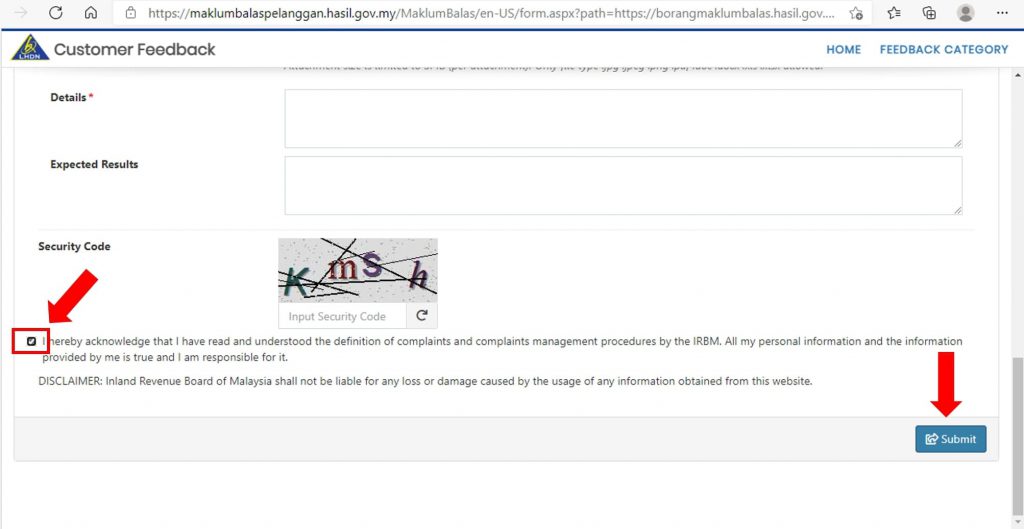

Lastly, check the agreement before you press the submission button.

Furthermore, if the employer has failed to perform the action above by submitting form CP22 and CP22A to the LHDN, the penalties are:

Form CP22: Failure to notify IRBM will render an employer liable to prosecution and on conviction,

- Fine for RM200 – RM2000 (not less than or not more than)

- Employer will be imprisonment for a term not exceeding six months or to both

- Employer is responsible all of the tax due from the above-mentioned employee

Form CP22A: Failure to notify IRBM will render an employer liable to:

- Fine for RM 200 – RM2000 (not less than or not more than)

- Employer will be imprisonment for a term not exceeding six months or to both

- Employer is responsible all of the tax due from the above-mentioned employee

With the integration of iFlexiHRMS TMS and Payroll system, the employer is able to set notification as a reminder for newly employee recruitment and employee retirement status. It prevents employer to missed out issuing the form and get penalty. The powerful TMS software and payroll solution will assist one company employer by handling several daily company task and complicated assignments.

Generate your CP22 & CP22A form with us!

Moreover, iFlexiHRMS allows you to one click generate CP22A form with the employee registered in your system. The iFlexiHRMS system simplify the process by avoiding the person in charge to fill CP22A form one by one for those employee.