Employee’s SOCSO contribution and EIS contribution are essential submission that should be made by both employee and employer. Both contribution fund are meant/serve different purposed. You may find out more about SOCSO contribution and SOCSO contribution rate and EIS contribution at the following pages:

SOCSO Contribution rate latest updated

EIS Contribution rate latest updated

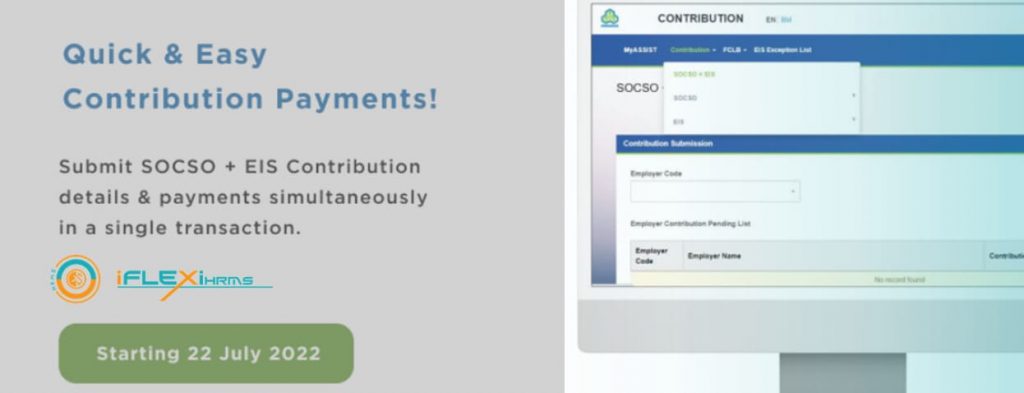

From the effective 22 July 2022, all of the employers are able to use the Assist Portal in perkeso website for submitting employee’s SOCSO contribution and EIS contribution (Forms and Payment) together!

Login to the Assist Portal here

How to submit SOCSO Contribution and EIS Contribution together?

Step 1: Login to perkeso website and click the drop down menu on top right navbar named ‘My Sites’. After that search for row ‘Contribution’

You will find ‘SOCSO + EIS Contribution’ wordings after page loaded.

Step 2: Go to the action button on ‘Employer Contribution Pending List’ table and click on it.

After that, search for SOCSO and EIS column in the table and click action button on the employee (to change an employee info such as Name, IC, Salary etc.)

Step 3: Enter information and Save Draft/Submit Contribution

How to calculate employee’s SOCSO contribution and EIS contribution in one go?

iFLEXiHRMS Payroll System allow you to one click process employee monthly salary calculation. It is a simple and easy payroll software system by allowing your company employee salary calculator Malaysia can be done easily and efficiency.

iFLEXiHRMS Payroll System free up your time from tedious and complex payroll calculations, preparation of pay slips and all statutory submissions. It built for your business, and grow with your business.